[ad_1]

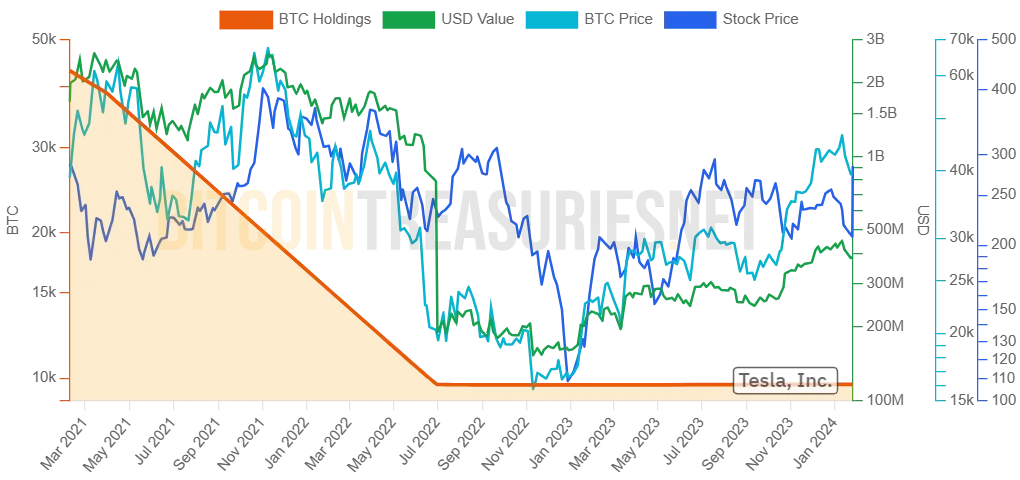

Although Tesla didn’t mention Bitcoin in its most recent quarterly earnings report, analysts have concluded that Tesla Inc.’s (TSLA) Bitcoin holdings remained steady in the last quarter of 2023. The electric car manufacturer’s cryptocurrency assets are valued at approximately $387 million at current prices, with over 9,720 BTC in its possession, according to Bitcoin Treasuries, an aggregator that follows well-known BTC wallets in the business world.

Tesla’s Bitcoin journey began in February 2021 with a substantial investment of $1.5 billion, acquiring around 43,000 BTC after an interaction between Elon Musk and Michael Saylor, CEO of MicroStrategy. The Elon Musk-led company briefly accepted Bitcoin as payment before concerns over environmental impact led to a shift in strategy, selling 75% of its holdings in Q2 2022 to bolster its cash position amid COVID-related uncertainties.

Both Tesla’s BTC purchases and Tesla’s dismissal of Bitcoin sparked tangible market movements. BTC reached an all-time high after Elon tweeted a pro-Bitcoin Tesla, and then lost over 75% of its value after Elon tweeted an anti-Bitcoin stance.

In contrast to Tesla’s moves, MicroStrategy has further augmented its Bitcoin portfolio. The company—co-founded and previously led by Michael Saylor—is the publicly traded company with the largest BTC treasury, with a reported 89,150 BTC in holdings worth $8.1 billion. Not a single Satoshi has been sold since the first purchase.

Tesla is the third company in the ranking, outpaced only by Marathon Holdings.

Tesla’s latest earnings report, published on Wednesday, was met with a 14% share drop due to weak auto revenue and warnings of slower growth in 2024. The report indicated a marginal increase in total revenue, up 3% from the previous year, but a notable dip in operating margin to 8.2%. The report emphasized the challenges faced by the automaker, which is not something investors want to hear.

Despite these setbacks, Tesla’s net income more than doubled in the quarter, primarily due to a significant noncash tax benefit. Looking ahead, the company is focusing on launching its “next-generation vehicle” in Texas, which may impact its vehicle volume growth in 2024.

Elon Musk, during the earnings call, addressed questions about his desire to own 25% of Tesla, indicating an interest in a potential shift towards a dual-class share structure. His comments underscored the ongoing tensions between corporate leadership and shareholder advisory boards.

“We’ve had a lot of challenges with institutional shareholder services … and there’s a lot of activists that basically infiltrate those organizations and have strange ideas about what should be done, so I want to have enough to be influential,” he said. “If we could do a dual-class stock, that would be ideal. I’m not looking for additional economics. I just want to be an effective steward of very powerful technology.”

The company’s foray into AI and robotics—marked by the launch of x.AI (a startup owned by Elon but independent from Tesla) and the development of the humanoid robot Optimus—represents a significant pivot. Musk described Optimus as “the potential to far exceed the value of everything else combined” for Tesla. The Cybertruck’s introduction to the market also marks a pivotal moment for the company, with an estimated capacity to build over 125,000 vehicles annually.

Tesla sold 75% of its BTC stash in Q2 2022 for $936 million. If the selling happened anytime after April 28, the company would have more money today than it received from the sales two years ago.

Edited by Ryan Ozawa.

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link