1 Month In: How Bitcoin ETFs Have Fared Since Their Highly-Anticipated Launch

[ad_1]

Spot Bitcoin ETFs have made a notable impact in the financial world, attracting significant inflows and driving the price of Bitcoin to its highest level in over two years, currently at $49,900, after briefly touching the $50,200 mark.

According to a Bloomberg report, these ETFs have achieved “unparalleled success” in trading measures, attracting billions of dollars in net inflows within just one month of their historic launch.

Bitcoin ETFs Garner $2.8 Billion In Net Inflows

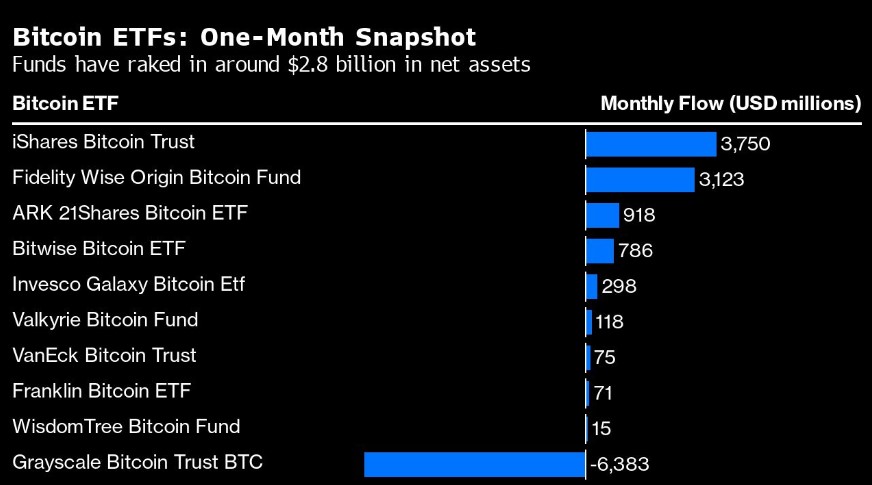

Data compiled by Bloomberg Intelligence reveals that the Bitcoin spot funds have amassed approximately $2.8 billion in net inflows during the first 21 trading days.

This figure considers the $6.4 billion withdrawn from the Grayscale Bitcoin Trust (GBTC) after transforming into an ETF. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have emerged as frontrunners, attracting around $3.8 billion and $3.1 billion in inflows, respectively.

Per the report, these two funds breached the $1 billion threshold within five days or less, making them the only ones to surpass $3 billion during their initial 20 days of trading.

Despite an initial sell-the-news sentiment, the success of Bitcoin ETFs has propelled Bitcoin’s price to its highest point in over two years. Jane Edmondson, head of thematic strategy at TMX VettaFi, told the news outlet that any ETF accumulating over $100 million in assets within a month is a success. However, the long-term economic viability of all these funds remains to be seen.

BlackRock And Fidelity Dominate Trading Volumes

Notably, Bloomberg remarks that while IBIT and FBTC lead the pack, other Bitcoin ETFs have experienced varying inflows.

The Bitwise Bitcoin ETF (BITB) and ARK 21Shares Bitcoin ETF (ARKB) have attracted approximately $786 million and $918 million, respectively. The Franklin Bitcoin ETF (EZBC) has gathered only $71 million despite having the lowest fees among the group. Similarly, the WisdomTree Bitcoin Fund (BTCW) has invested $15 million. Nonetheless, overall flows into these ETFs continue to remain strong.

The high trading volumes of the BlackRock and Fidelity funds, each surpassing $6 billion in shares traded since their inception, underscore the ease of trading assets under an ETF structure. This further reinforces the long-standing demand for Bitcoin funds among investors.

However, according to Bloomberg, while these Bitcoin ETFs are available to the general public, certain institutions still maintain reservations.

LPL Financial, manager of trillions of dollars in capital, requires further convincing of the ETFs’ suitability for their trading platforms and assurance that the selected funds will not be discontinued.

Even Vanguard Group Inc., a traditional firm, has refrained from offering the new ETFs on its vast trading platform. However, experts anticipate increased interest and flow once these ETFs gain wider acceptance and familiarity among investors.

On average, Bitcoin ETFs have made an indelible mark on the financial landscape, attracting billions of dollars in inflows within a month of their launch. The success of these ETFs, led by BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund, has not only boosted investor confidence but also pushed the price of Bitcoin to a 26-month high.

While the performance of other Bitcoin ETFs varies, overall market response remains positive. As these ETFs gain further traction and acceptance, interest and investment are expected to continue to grow, shaping the future of cryptocurrency in traditional finance.

Featured image from Shutterstock, chart from TradingView.com

[ad_2]

Source link