Why Cathie Wood’s ARK Sold $24 Million in Crypto Stock at Peak

[ad_1]

Cathie Wood’s ARK Invest divested over $24 million in Coinbase (COIN) stock this Monday, just as Bitcoin edged closer to its all-time highs.

Consequently, Coinbase’s stock dipped 5.2% to close at $216.77 on Tuesday.

Cathie Wood’s Ark Invest Sells Off Coinbase Stock

ARK offloaded 110,896 shares in a deal worth approximately $24.03 million through the following funds:

- ARK Innovation ETF (ARKK)

- ARK Next Generation Internet ETF (ARKW)

- Ark Fintech Innovation ETF (ARKF)

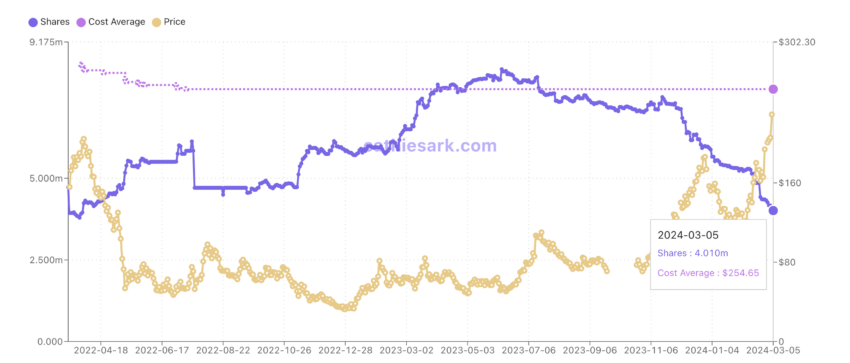

In response to the market’s bullish trend, Wood began reducing her stake in Coinbase. Specifically, the ARKK’s holding of Coinbase shares has almost halved since October 2023. The ETF owned roughly 7 million shares in October 2023.

However, by Tuesday, the figure had dwindled to about 4 million amidst the stock’s approximate 175% rally during this period.

Read more: Coinbase Review 2024: The Best Crypto Exchange for Beginners?

The decision to sell came on the heels of Bitcoin’s rally, with Coinbase experiencing operational hiccups due to increased platform traffic. Notably, these issues left some users to grapple with inaccurate account balances. Amid these technical snags, a Coinbase user vented on X, expressing frustration over the platform’s unreliability during crucial trading times.

“You can literally never buy the bottom or sell the top [on Coinbase]. You can only buy the [expletive] prices in between. I am going to go out of my way to short their [expletive] stock when the time is right. I wish them nothing but the worst,” pseudonymous X user Rain said.

Why Has COIN Been Rallying?

This surge in Coinbase’s stock value was partly fueled by BlackRock’s reapplication for a Bitcoin ETF in July 2023, which notably included Coinbase as a partner. This partnership was significant as it underscored Coinbase’s role amidst the SEC’s concerns regarding spot Bitcoin ETFs and ongoing legal issues facing the exchange.

Additionally, the Chicago Board Options Exchange’s application for a Fidelity-managed spot Bitcoin ETF also spotlighted Coinbase. The filing named Coinbase as the crypto platform for monitoring market manipulation. All-in-all, ten of the 11 newly approved Bitcoin ETFs have tapped Coinbase as their primary custodian.

These updates have shattered many analysts’ bearish predictions from last year. In June 2023, Berenberg Capital forecasted a 50% plummet in Coinbase stock, setting a target of $39.

Read more: Top 5 Crypto Companies That Might Go Public (IPO) in 2024

The bearish forecast continued in January 2024, when JPMorgan analyst Kenneth Worthington set an $80 price target, suggesting potential challenges ahead despite a strong rally in the latter half of 2023. This target indicated a considerable downturn of over 35% from its valuation at the start of the year.

As of March 2024, Coinbase’s stock still remains about 50% below its all-time high from May 2021.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link